Compound interest calculator with yearly contributions

You choose if and how much you want to invest monthly min R1 000 and can increase decrease stop and restart your contributions whenever you want to. I Increase yearly contributions by.

Compound Interest Calculator Arrest Your Debt

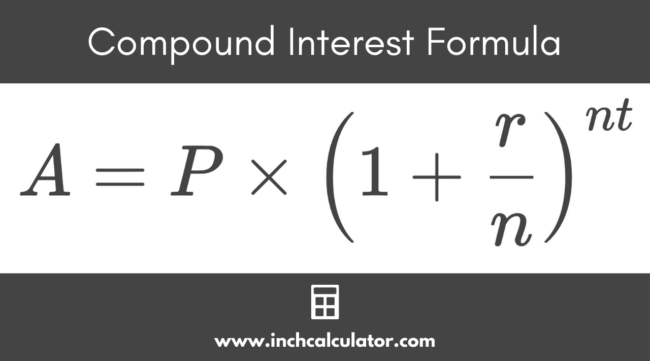

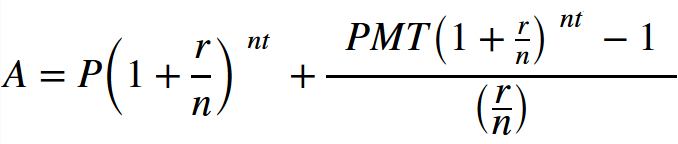

P the principal investment amount the initial deposit or loan amount.

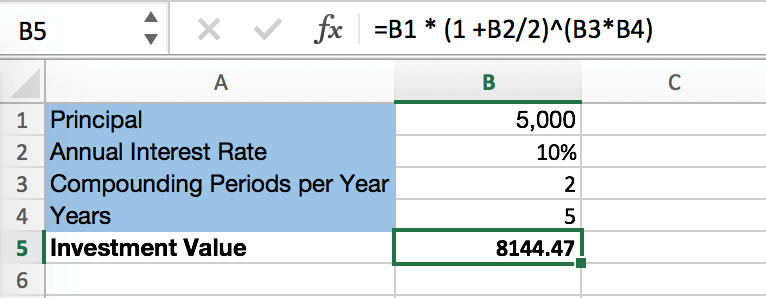

. And the effect on a stocks and shares ISA or pension can be powerful. N the number compounding periods per year n 1 for annually n 12 for monthly. The interest can be compounded annually semiannually quarterly monthly or daily.

F final amount obtained. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and student.

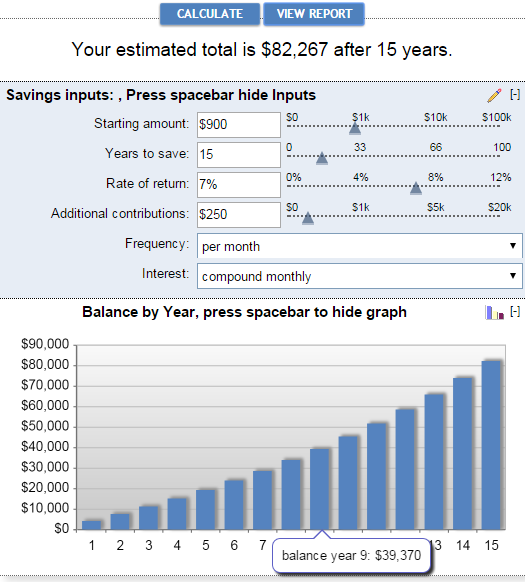

Include additions contributions to the initial deposit or investment for a more detailed calculation. The compounding frequency is the number of times per year or rarely another unit of time the accumulated interest is paid out or capitalized credited to the account on a regular basis. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance.

Its worth noting that this formula gives you the future value of an. I start with an initial amount and an yearly interest rate applied will be applied to it. A the future value of the investmentloan including interest.

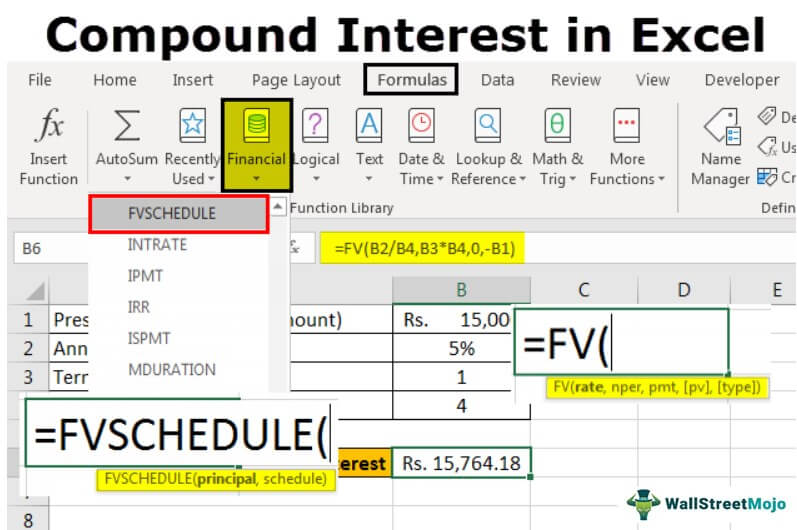

Future Value Inflation Adjusted. The detailed explanation of the arguments can be found in the Excel FV function tutorial. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon.

A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts. N the number of times that interest is compounded per unit t. Interest can be compounded daily weekly or yearly.

Compound interest is calculated using the compound interest formula. With compound returns its less about how much you can afford to invest and more about how long the investment has time to growThe basic concept of returns on returns is simple. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

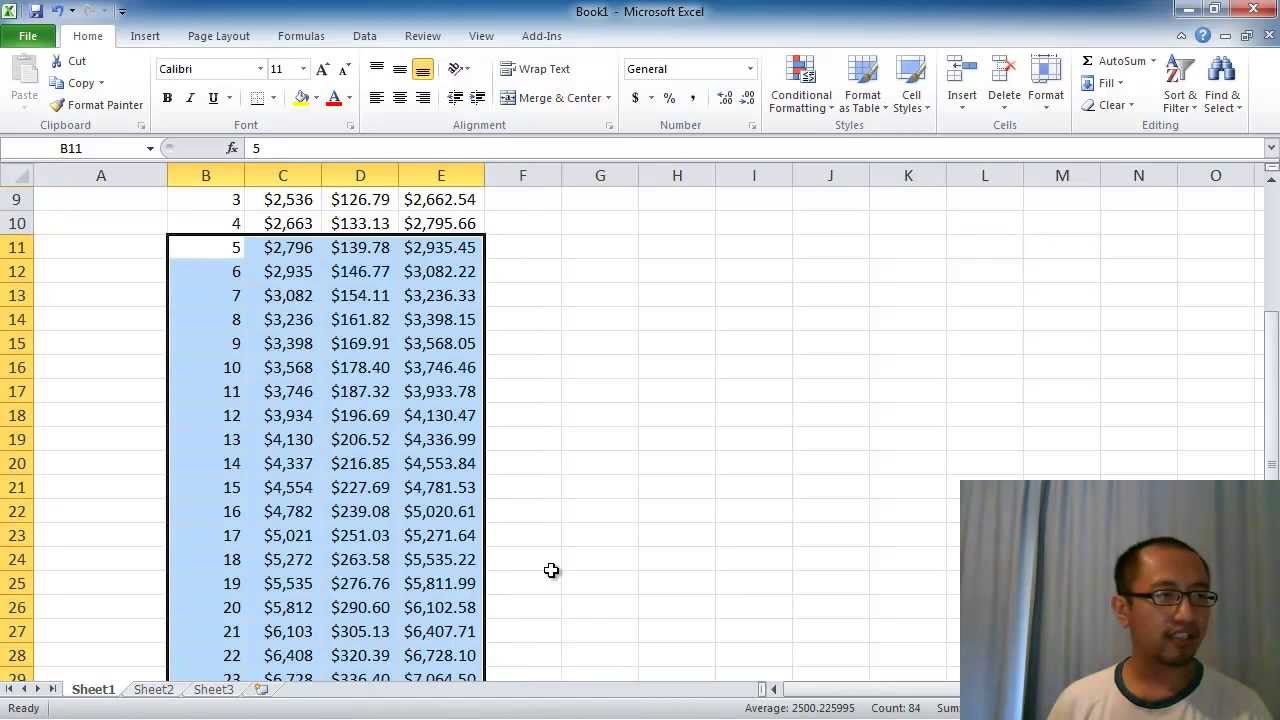

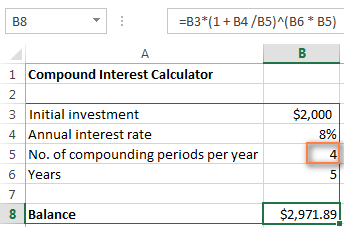

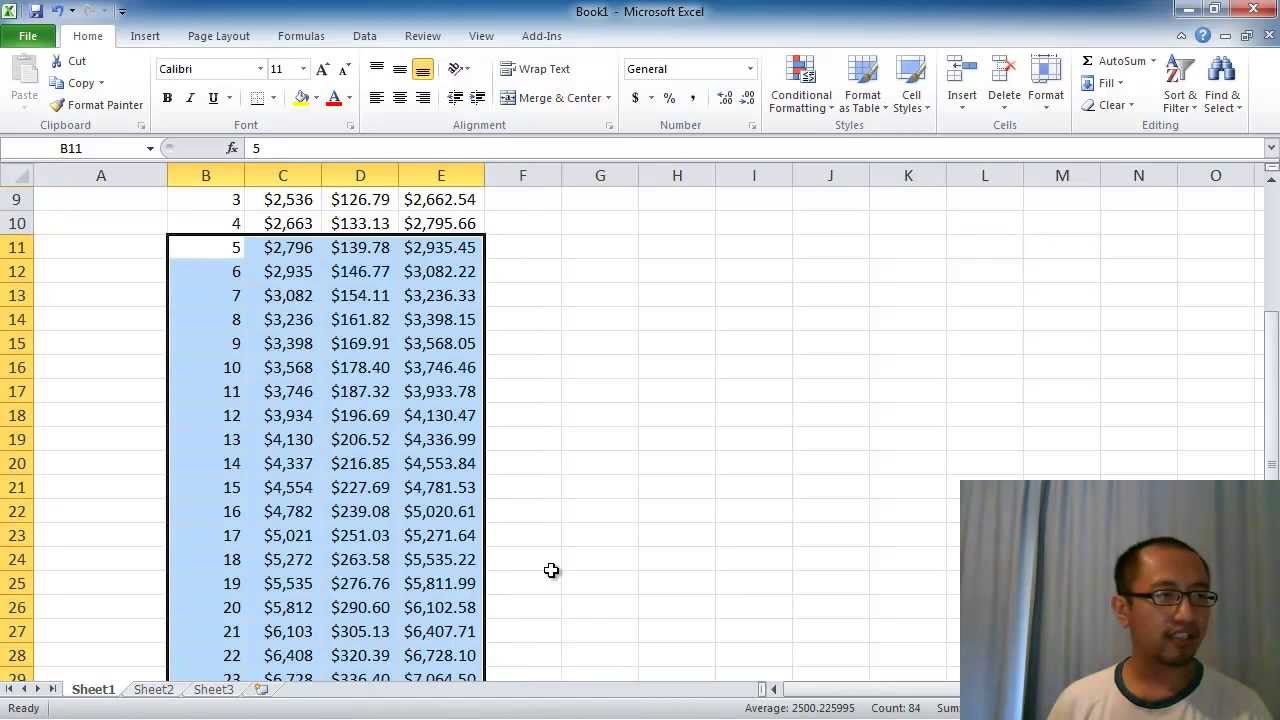

Subtract the initial balance if you want to know the total interest earned. As you may remember we deposited 2000 for 5 years into a savings account at 8 annual interest rate. Choose daily monthly quarterly or annual compounding.

Treasury savings bonds pay out interest each year based on their interest rate and current value. Normally the longer that money is left in a CD the higher the rate of interest received. I the one-year prohibition on seeking or accepting employment or any form of compensation or financial benefit from any contractor or vendor with whom a former staff member has had personal.

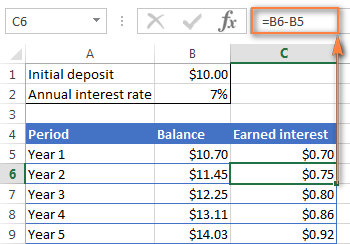

Interest paid in year 1 would be 60 1000 multiplied by 6 60. Calculate interest compounding annually for year one. How to calculate compound interest.

Yearly Interest Yearly Tax Total Interest Total Tax Balance Inflation Adjusted. With our compound returns calculator well give you an estimate of the benefit. Assume that you own a 1000 6 savings bond issued by the US Treasury.

You should invest at least. Use our free compound interest calculator to estimate how your investments will grow over time. We have a CD Calculator for investments involving CDs.

For example monthly capitalization with interest. See how much you can save in 5 10 15 25 etc. R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the.

How to Grow Your Investments With Compound Interest. Get 247 customer support help when you place a homework help service order with us. P the principal investment amount the initial deposit or loan amount also known as present value or PV.

Compound interest can have a dramatic effect on the growth of regular savings and lump sum deposits. R is also known as rate of return. See how compound interest can increase your savings over time.

An MMM-Recommended Bonus as of August 2021. The frequency could be yearly half-yearly quarterly monthly weekly daily or continuously or not at all until maturity. I Enter average annual inflation rate.

Are you investing monthly. You earn interest on top of interest. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods.

R the annual interest rate decimal. Compound Annual Growth Rate CAGR. This calculator is not a financial planning tool.

To calculate the profits from your forex trading we enter your starting balance percentage and number of months into the formula for compound interestThe calculation returns a compounded projection figure for future earnings to guide you as to what profits you might see from your foreign exchange trading. Your money earns interest every day if it compounds daily and then the next days interest is calculated based on THAT total instead of on the principal. Our compound interest calculator will help you discover how your money could grow over time using the power of compounding interest.

The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term. Your books and I together have got to 2015 with most of the loans the interest-bearing ones anyway paid off a car owned outright and almost enough in my offset account to make my mortgage payments interest free albeit with the help of a legacy along the way. N the deposits will be made for 10 consecutive years.

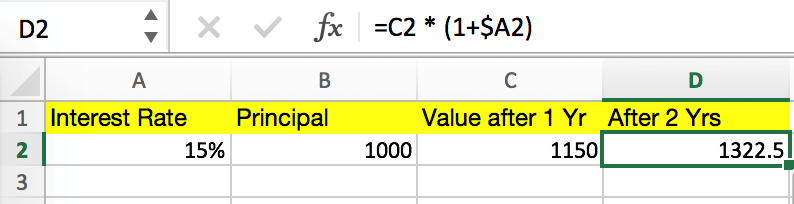

This article steps you through ten calculations starting with the compound interest formula then building a series of compound interest examples to demonstrate variations. Other low-risk investments of this type include savings accounts and money market accounts which pay relatively low rates of interest. Initial balance or deposit Annual savings amount Annual increase in contributions 0 to 10 Number of years for the analysis 1 to 30 Assumptions.

Years at a given interest. I use a 4-year time period for the first group to explain the calculations then expand to a 40-year horizon and add a few charts to show the magic of compound interest. Weve got a compound interest calculator that will do the calculations for you.

Increase your contributions instead of increasing your standard of living. Id like to know the compound interest formula for the following scenario. Compound interest works best as an investment tool - for example if you deposit 1000 in the bank and earn 5 per year with interest paid every month the interest earned each month is re-invested with your original 1000 and begins to earn its own interest.

A the future value or FV of the investmentloan including interest. T the time the money is invested or borrowed for. Use this calculator to determine the potential future value of your savings.

P Initial Amount i yearly interest rate A yearly contribution or deposit added. Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate. R the annual interest rate expressed in decimal form decimal 100.

In the meantime lets build a FV formula using the same source data as in monthly compound interest example and see whether we get the same result. Risk is a key factor when making bond investments.

Quarterly Compound Interest Calculator Discounted Shop 54 Off Lamphitrite Palace Com

Compound Interest Definition Formula How It S Calculated

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator Inch Calculator

Compound Interest Formula And Excel Calculator The Investment Mania

Compound Interest Calculator For Excel

Compound Interest Formula And Calculator For Excel

Compound Interest Formula In Excel And Google Sheets Automate Excel

How To Work Out Compound Interest On Savings 14 Steps

Compound Interest Formula In Excel And Google Sheets Automate Excel

Compound Interest Formula In Excel Step By Step Calculation Examples

Microsoft Excel Lesson 2 Compound Interest Calculator Absolute Referencing Fill Down Youtube

Compound Interest With Monthly Contributions Calculator Formula

Compound Interest Formula And Calculator For Excel

Compound Interest Ci Formulas Calculator

Compound Interest Formula And Calculator Excel Template

Compound Interest Formula And Calculator For Excel