Annuity with inflation formula

How do you calculate an annuity. Finding the future value of the annuity is important to accommodate inflation with time.

Romans 5 8 9 Romans 5 Romans 5 8 Wrath

Future Value of an Annuity C 1in - 1i where C is the regular payment i is the annual.

. The calculation of an annuity follows a formula. Now to suit the question asked we can see that ifixed rate of return f and g expected inflation rate e such that we can rewrite the equation as PVGPD C_0 1e. According to the US.

The ordinary annuity formula is explained below along with solved examples. An annuity investment that. Ad Learn More about How Annuities Work from Fidelity.

By using the geometric series formula the present value of a growing annuity will be shown as This formula can be simplified by multiplying it by 1r 1r which is to multiply it by 1. 3841 yarbrough ave winston-salem nc 27106. Securities and Exchange Commission the real rate is the true economic benefit offered by an investment after taking into account taxes and inflation.

At the end of the first year our principle is p 1 p 0-w 0Y 1 At that point we withdraw w 1 dollars and then let the remaining principle gather interest for a year at the end of which time. Real Return 1 nominal return1 inflation 1 To make a real return of 2 he will need to make a nominal return of 4 assuming inflation of 196 1 02 1 x10196 Solve for. Ad Learn More about How Annuities Work from Fidelity.

The primary risk of most annuity payouts therefore is inflation. The algorithm behind this annuity payment calculator is based on the. Learn some startling facts.

Ad Get this must-read guide if you are considering investing in annuities. Ad BlackRock Offers Solutions for Building Inflation-Resilient Portfolios in Todays Market. Please note this field is optional.

Learn Which Strategies We Recommend in a Higher Inflationary Environment. Inflation rate is the average expected CPI that affects the purchasing power of the money. As a financial term used for time-value of money calculations.

Annuities are often complex retirement investment products. An inflation-protected annuity IPA is a type of annuity product. If your annuity pays a fixed 3000 per month for life and inflation increases 10 the buying power of your annuity.

These annuities tend to provide a lower payout to investors than other types of annuities on the market. Ad Compare Annuity Rates From Over 31 Top Companies Instantly. An inflation-adjusted annuity payment something you might want to consider for retirement.

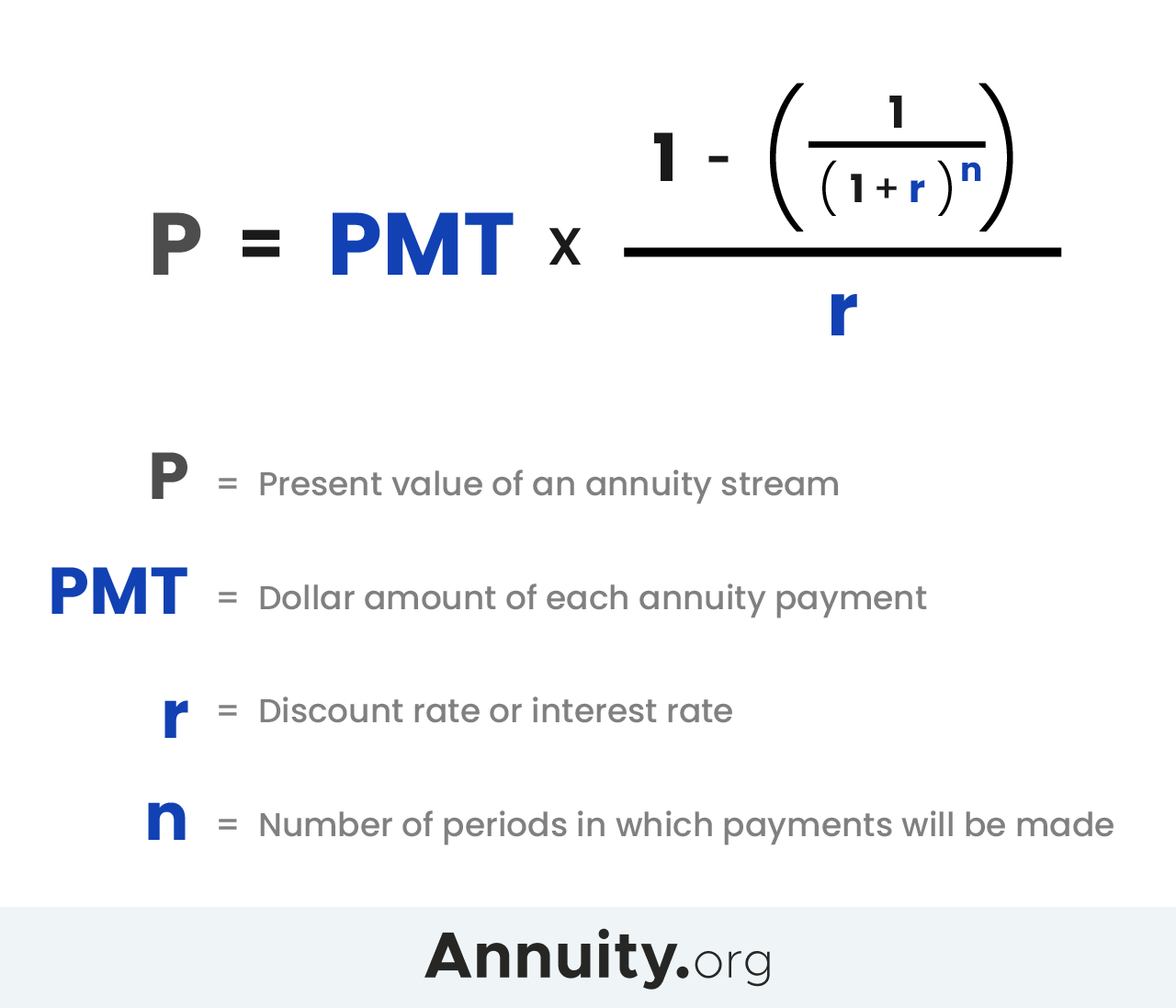

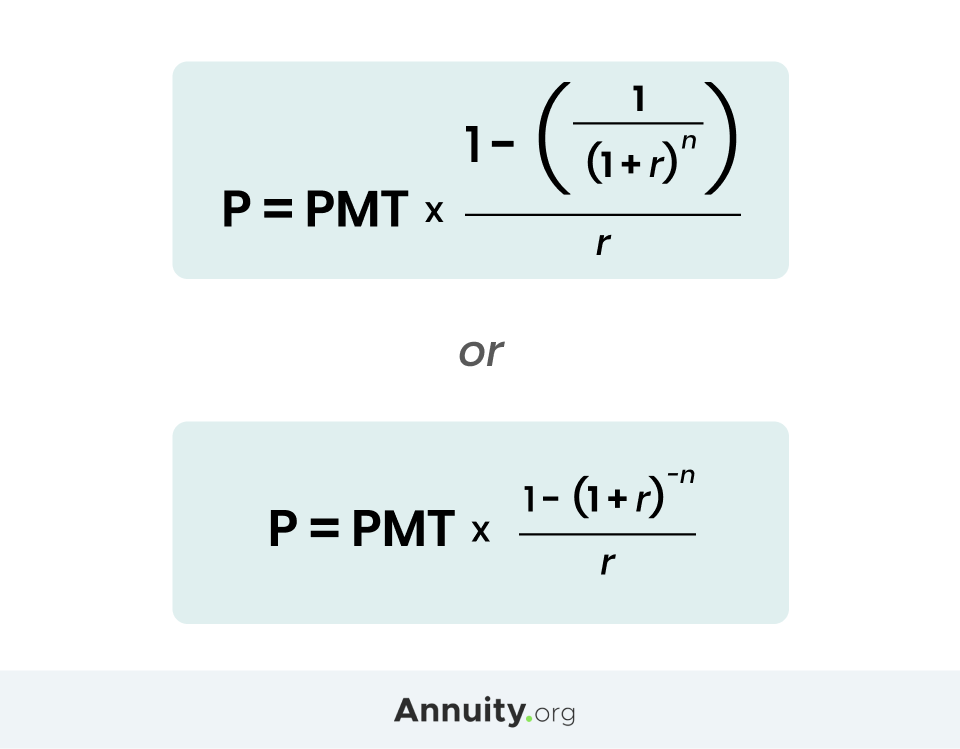

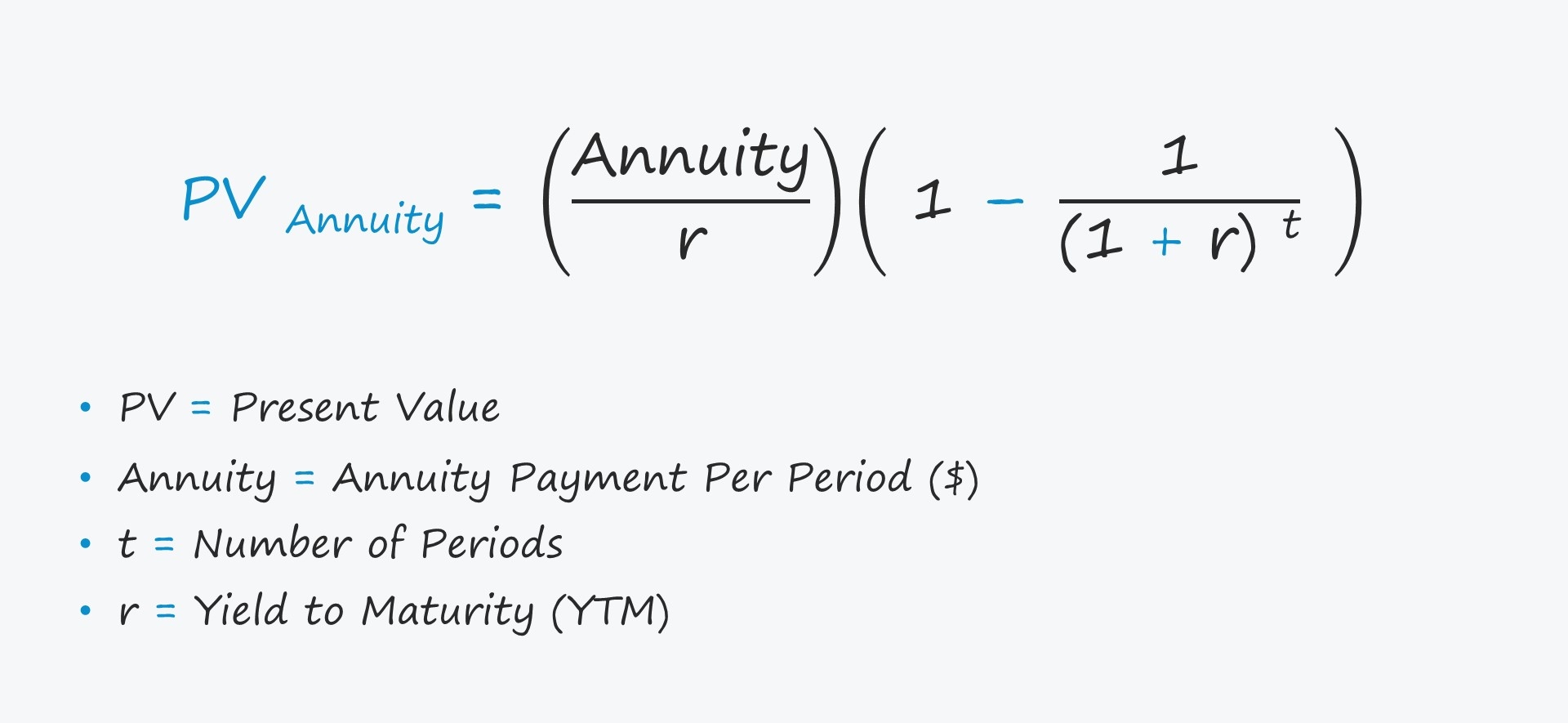

The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where.

Growing Annuity Formula With Calculator Nerd Counter

Real Interest Rate Formula Double Entry Bookkeeping

Perpetuity In 2022 Economics Lessons Accounting And Finance Finance

Fv Function Learning Microsoft Excel Excel Templates

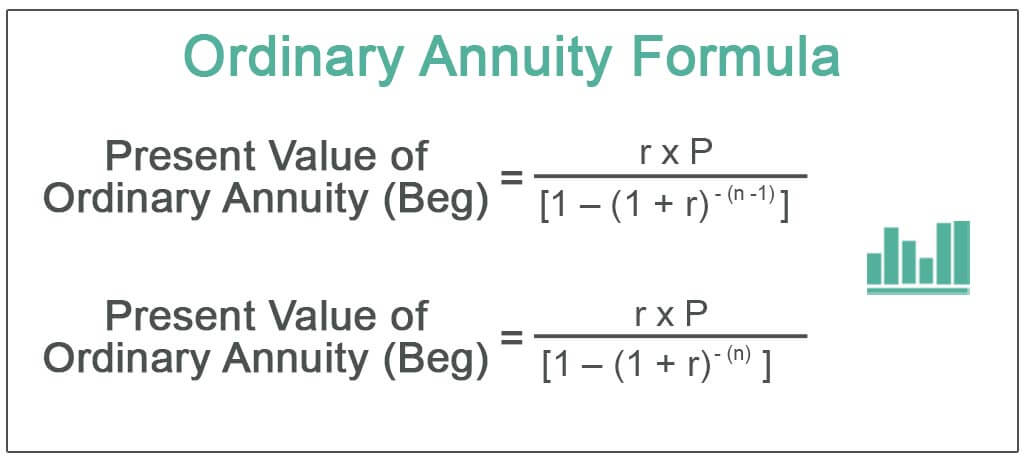

Ordinary Annuity Formula Step By Step Calculation

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

Calculating Present And Future Value Of Annuities

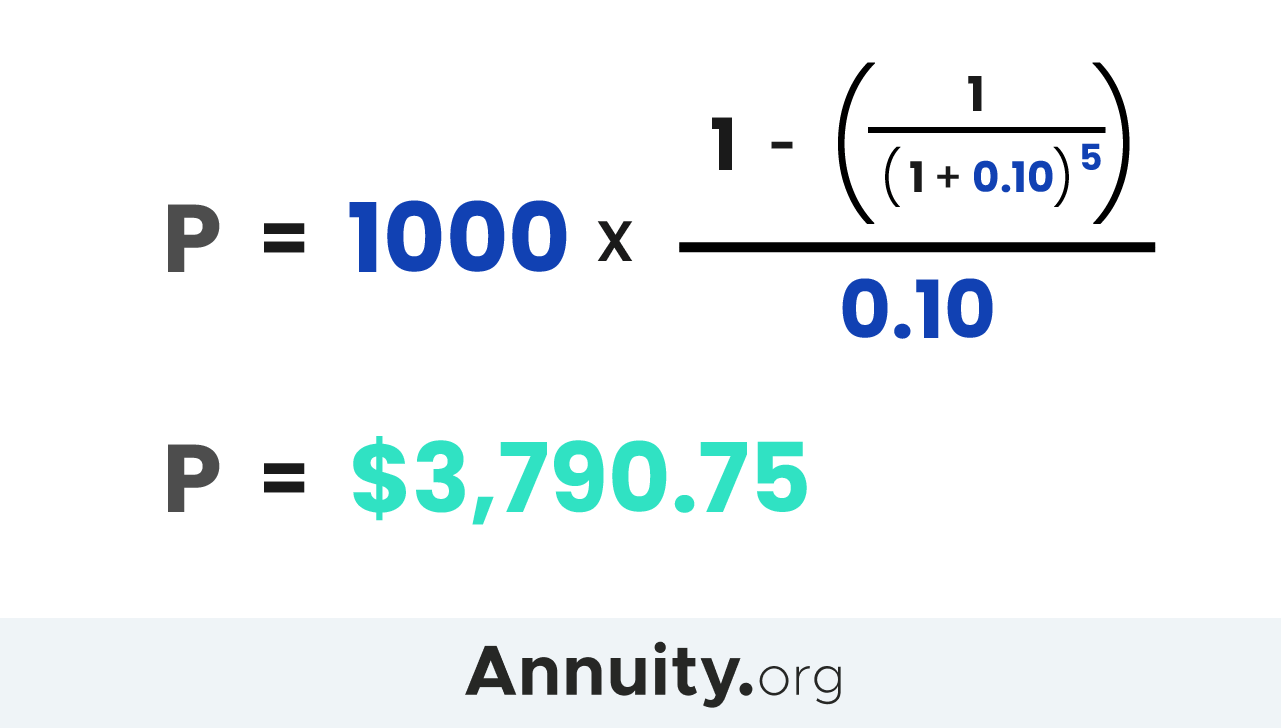

Present Value Of An Annuity How To Calculate Examples

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Present Value Of A Growing Annuity Formula With Calculator

Break Even Analysis Template Business Management Degree Analysis Startup Business Plan Template

Time Value Of Money Tvm Formula And Example Calculation

2

What Is An Annuity Table And How Do You Use One

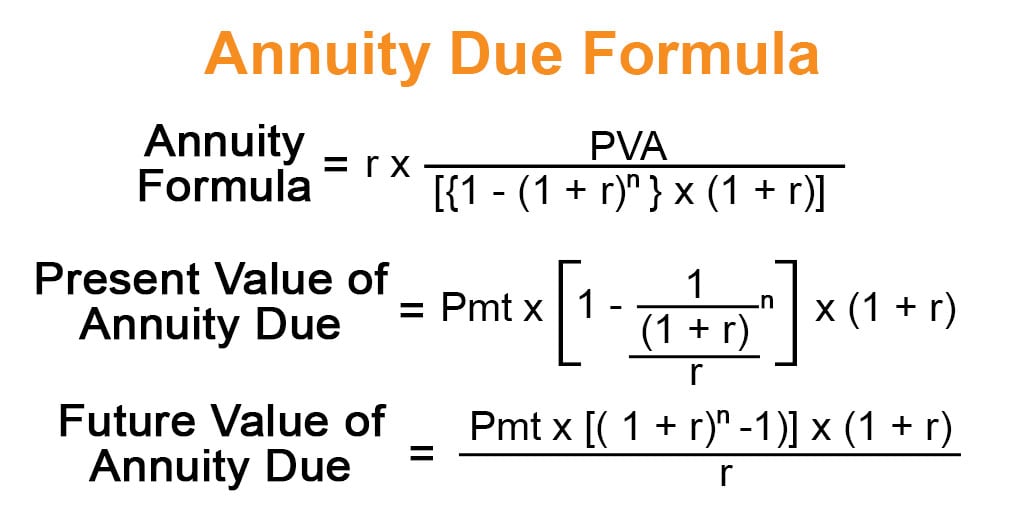

Annuity Due Formula Example With Excel Template

Annuity Present Value Pv Formula And Calculator Excel Template

Present Value Of An Annuity How To Calculate Examples